The recipe for urban decay has flopped

New Geography published an article: Australia’s Recipe For Urban Decay written by Clinton Stiles-Schmidt. This article is critical of Australia’s urban planning policy to establish high-density urban living in our cities. The article speculates this strategy will result in neighbourhoods that have slum-like conditions, social tension, and perpetual poverty for their residents.

The article projects property investors having a speculative investment strategy, willing to neglect their investments by not performing ongoing maintenance. This results in deterioration of their properties and the surrounding neighbourhood. This will be most prevalent in areas with high-density housing, as investors are predominatly the buyers, paying higher prices to buy units/apartments. This forces owner occupiers and first home buyers out of that market and further erodes housing quality because investors will not perform the necessary upkeep of their properties. We disagree.

There are several things wrong with the article’s assertions. We feel Clinton has assumed some of the characteristics that occur in the US property market also apply to the Australian market and this is not the case.

Property Investors are not speculative nor neglectful

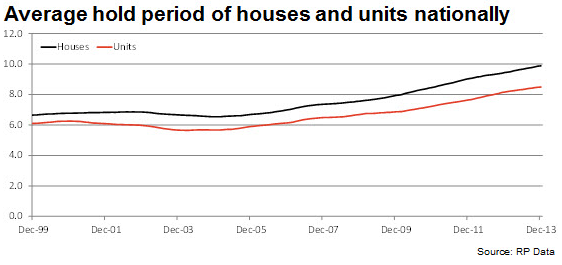

Property data shows at 2011 there were about 1.28 million property investors. Most of these are “Mums and Dads” investors with 72.8{1897c8b751ad578bd9a969480021909bcd327853590acbf66d5abd5e194cce96} owning just one property. Only 18.9{1897c8b751ad578bd9a969480021909bcd327853590acbf66d5abd5e194cce96} of investors owned 2 properties while just 0.9{1897c8b751ad578bd9a969480021909bcd327853590acbf66d5abd5e194cce96} of investors owned 6 or more. The data also shows that residential property owners are holding onto their homes for longer. At the end of 2012, the average length of ownership for properties sold in that year was 9.3 years for houses and 8.2 years for units. Ten years ago, the average hold period for a house was 6.8 years and for a unit it was 5.9 years.

This data does not support Clinton’s claim that property Investors are speculative. If this was the case you would expect more investors to own two or more properties. Also, the holding time between reselling homes would be decreasing, not increasing, especially for units. Instead, the data shows investors view property as a long-term investment.

Clinton fails to account for Australia’s rental market being heavy regulated by the various State Governments. There are significant penalties for landlords who fail to provide a habitable and well-maintained dwelling for their tenants. Given this regulatory requirement and long-term investment strategy, why would an investor spend hundreds of thousands of dollars purchasing an investment property, then not maintain it?

The article states this of investors: “They are seeking rental income from tenants as well as appreciation in the value of both the property and the underlying land.” Keeping a well maintained the property allows them to meet their long-term goal of value appreciation and of attracting and holding quality tenants.

Housing affordability remains steady

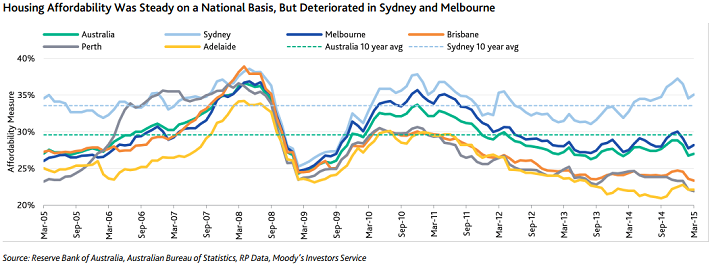

The article presents a number of graphs comparing monthly rent and mortgage payments from 2001 to 2011. However, this data hasn’t been adjusted for CPI (Consumer Price Index) when comparing these 10-year intervals. This makes the figures seem worse than they actually are. The article implies the increase in rents and mortgage payments over this time is creating a housing affordability issue. This is true only for the Sydney market and to a lesser extent Melbourne, but not any other Australian city. Moody’s Australian Housing Affordability Measure released April 2015, has determined overall Australia’s housing affordability has remained steady and is at the same levels it was 10 years ago. In cities such as Brisbane, Adelaide and Perth, affordability has improved over what it was 10 years ago.

No white flight

Many large US cities, such as Chicago and Detroit, introduced schemes to create high-density inner city housing. This resulted in middle-class minorities moving into these inner suburbs. It also resulted in the mostly white affluent residents in those areas moving further away to outer suburbs. A phenomenon known has white flight.

The city loses the tax base provided by these white residents leaving it with falling tax revenues, a struggling economy, and no resources to spend on services. Over time, low-income residents move into these areas causing urban decay and slum-like conditions. Clinton is speculating the same will occur in our cities. We disagree. We are not seeing the white flight phenomenon in Australia.

In Australia, much of the high-density development is occurring in and around the city centres or suburban transport/shopping hubs. In many of these inner city areas re-gentrification is also taken place. This, in turn, is making these areas highly desirable to live in. Residents are attracted to the walkability of these locations, given proximity to cafés, restaurants, shopping and public transport.`

Negative Gearing results in long-term neglect

The article suggests: “Investors, looking primarily at tax advantages, are less likely to improve the properties or even maintain existing structures.” Clinton has provided no evidence to support this assertion. There is no relationship between an investor getting a negative gearing tax deduction and them not maintaining their investment property. Also, any maintenance costs are tax deductible.

Strata-titling results in neglect

The article acknowledges strata/community titles have been in place for over forty years, commencing in 1961. This property management structure has successfully allowed owners to buy and maintain apartments/units in multiple dwelling complexes. Strata-title provides for the formation of a body corporate/strata manager. These entities are legally responsible for maintaining the building’s common areas and external structure, ensuring they are safe and functional.

The statement in the article: “strata titling’s lack of consideration for common areas poses a serious issue in the long run for the maintenance of high-rise buildings and their surrounding neighbourhoods” is false. The body corporate is responsible for this. There are issues with some sinking funds are held by body corporate managers and used to finance maintenance of the building’s common areas. However, this does not release the body corporate from their legal obligations and strategies to address this issue must be found (i.e. introduce a special levy).

This is not the situation in the US. Multi-dwelling buildings consisting of two or more units, known as multi-family housing, are normally owned by a single investor/corporation. In many US states, building complexes of 5 units or less are “unregulated” giving the landlord enormous power over their tenants in terms of what rent they can charge and what facilities they will provide and maintain. In this environment, there is little incentive and no regulatory requirement for the landlord to maintain their properties to a high standard and many landlords neglect building maintenance. This leads to a degradation of the building and its neighbourhood.

Poverty is moving to the urban fringe

This article is advocating for more urban sprawl. Recent data for Sydney is showing the outer western suburbs of Sydney are becoming enclaves for the working poor. Much of the housing stock is in an increasingly dilapidated state, creating urban slums and undermining property values. Residents in these outer suburbs are getting poorer while former inner-city areas have transformed into exclusive enclaves of wealth and opportunity.

Commuting also divides inner-city and outer-city residents. Bureau of Statistics data shows nearly 60 percent of workers living close to Sydney’s CBD gets to work on public transport, by bicycle or by foot. In Blacktown, the proportion was just 7 percent (80 percent used a private vehicle).

It is a phenomenon being seen around the world. A recent paper by Allen Berube showed from 2000 to 2012, poverty in America rose much more rapidly in suburbs. The number of poor individuals living in big cities in the 100 largest metropolitan areas rose by 29 {1897c8b751ad578bd9a969480021909bcd327853590acbf66d5abd5e194cce96} over that period, compared to 65{1897c8b751ad578bd9a969480021909bcd327853590acbf66d5abd5e194cce96} in communities outside of the cities. In London, there are now more people living in poverty in outer London (1.22 million) than in the centre of the city (1.02 million). Something that wasn’t the case 10 years ago.

Urban planners understand these issues and are using high-density development and urban renewal to transform our inner cities. Clinton advocates more urban sprawl that will condemn owner occupiers and first time home owners into outer suburbs. Suburbs that are poorly support by infrastructure, far from employment hubs and over time have every possibility of deteriorating into neighbourhoods of working poor.

Policies of greater urban density have been in effect now for over 20 years and we haven’t seen the “urban decay” predicted by this article. We have to go “up”, not “out”.